mebel-na-zakaz-novosibirsk.ru

Market

Ira Investment Advice

Discover IRA investment options with Vanguard. Explore various choices, understand their benefits, and find the best fit for your retirement savings goals. A simple, easy way to get a low cost, professionally designed portfolio, automated investing technology, and access to financial advisors if and when you. IRA stands for Individual Retirement Account. Unlike a (k), IRAs aren't tied to an employer and they can be easier to withdraw from. Why invest in an IRA? IRAs allow you to save for retirement and potentially take advantage of tax benefits. Depending on which IRA you choose, your tax. An IRA is for individuals with taxable compensation who are planning for retirement. Why invest in an IRA? The tax advantages of an IRA may. Depending on your financial circumstances, needs and goals, you may choose to roll over to an IRA or convert to a Roth IRA, roll over an employer-sponsored plan. Investing your IRA doesn't need to be difficult. Learn how to invest your Roth or traditional IRA in order to maximize your retirement savings. Team up with a dedicated advisor from Fidelity® Wealth Management who can provide customized planning and investment management that's designed for your full. 1. S&P index funds. One of the best places to begin investing your Roth IRA is with a fund based on the Standard & Poor's Index. Discover IRA investment options with Vanguard. Explore various choices, understand their benefits, and find the best fit for your retirement savings goals. A simple, easy way to get a low cost, professionally designed portfolio, automated investing technology, and access to financial advisors if and when you. IRA stands for Individual Retirement Account. Unlike a (k), IRAs aren't tied to an employer and they can be easier to withdraw from. Why invest in an IRA? IRAs allow you to save for retirement and potentially take advantage of tax benefits. Depending on which IRA you choose, your tax. An IRA is for individuals with taxable compensation who are planning for retirement. Why invest in an IRA? The tax advantages of an IRA may. Depending on your financial circumstances, needs and goals, you may choose to roll over to an IRA or convert to a Roth IRA, roll over an employer-sponsored plan. Investing your IRA doesn't need to be difficult. Learn how to invest your Roth or traditional IRA in order to maximize your retirement savings. Team up with a dedicated advisor from Fidelity® Wealth Management who can provide customized planning and investment management that's designed for your full. 1. S&P index funds. One of the best places to begin investing your Roth IRA is with a fund based on the Standard & Poor's Index.

Individual retirement accounts (IRAs) are personal retirement savings accounts that offer tax benefits and a range of investment options. If you want to invest your IRA, TIAA can help you assess your IRA investment options investment advice under ERISA. This material does not take into account. A financial advisor can help provide you with the information you need to decide if a traditional or Roth IRA best suits your financial goals. Traditional IRAs have tax-deductible contributions (with some exceptions noted below), while the money used to fund a Roth IRA is contributed post-tax. As a. 1. Start Early · 2. Don't Wait Until Tax Day · 3. Think About Your Entire Portfolio · 4. Consider Investing in Individual Stocks · 5. Consider Converting to a Roth. The best way to grow money in a Roth IRA is by investing in assets that will appreciate over time and that can generate an income, such as bonds and dividend. The Internal Revenue Code and the IRS guidelines regarding investments in an IRA or other retirement account are exclusive rather than inclusive: we're only. But in reality, a Rollover IRA is a traditional IRA or Roth IRA with the same tax advantages and contribution limits. (k) accounts are tied to the company. Roth IRA · Pay taxes now. · Receive tax-free withdrawals from qualified distributions. · May be a good option if you're in a lower tax bracket. · Minimum investment. At Wells Fargo Advisors, the Full Service Brokerage Individual Retirement Account (IRA) lets you invest with personal guidance from a professional financial. Understanding IRA rules can help you make informed IRA decisions. Learn how IRAs work when it comes to contributions, tax deductibility, and withdrawals. Don't ignore the risks of a self-managed IRA · Make sure you have the appropriate investment expertise. · Steer clear of emotional decision-making. · Be aware of. IRAs allow you to make tax-deferred investments to provide financial security when you retire. Putting that same stock inside a traditional IRA, you lose the more favorable capital gains treatment because the investment is taxed at ordinary income tax. Use mutual funds or exchange-traded funds (ETFs) as the base of your IRA portfolio. These professionally managed portfolios allow you to build a well-. Questions to Ask an Investment Advice Provider · Will I have to change my investments if I move my retirement savings to an IRA or a different (k)? · How do. No matter how far away retirement seems, the sooner you start investing, the more time you have for compound interest to help your money grow. And an IRA is. The most popular kinds of IRAs are traditional IRAs and Roth IRAs. The combined maximum yearly contribution to both accounts is $7, for —or $8, if you. Owning a Vanguard IRA means you get flexibility. We have a variety of accounts and investments to choose from. Investments in a Roth IRA are made with after-tax dollars and are not tax deductible. Federal (and possibly state) income taxes are not due upon distribution of.

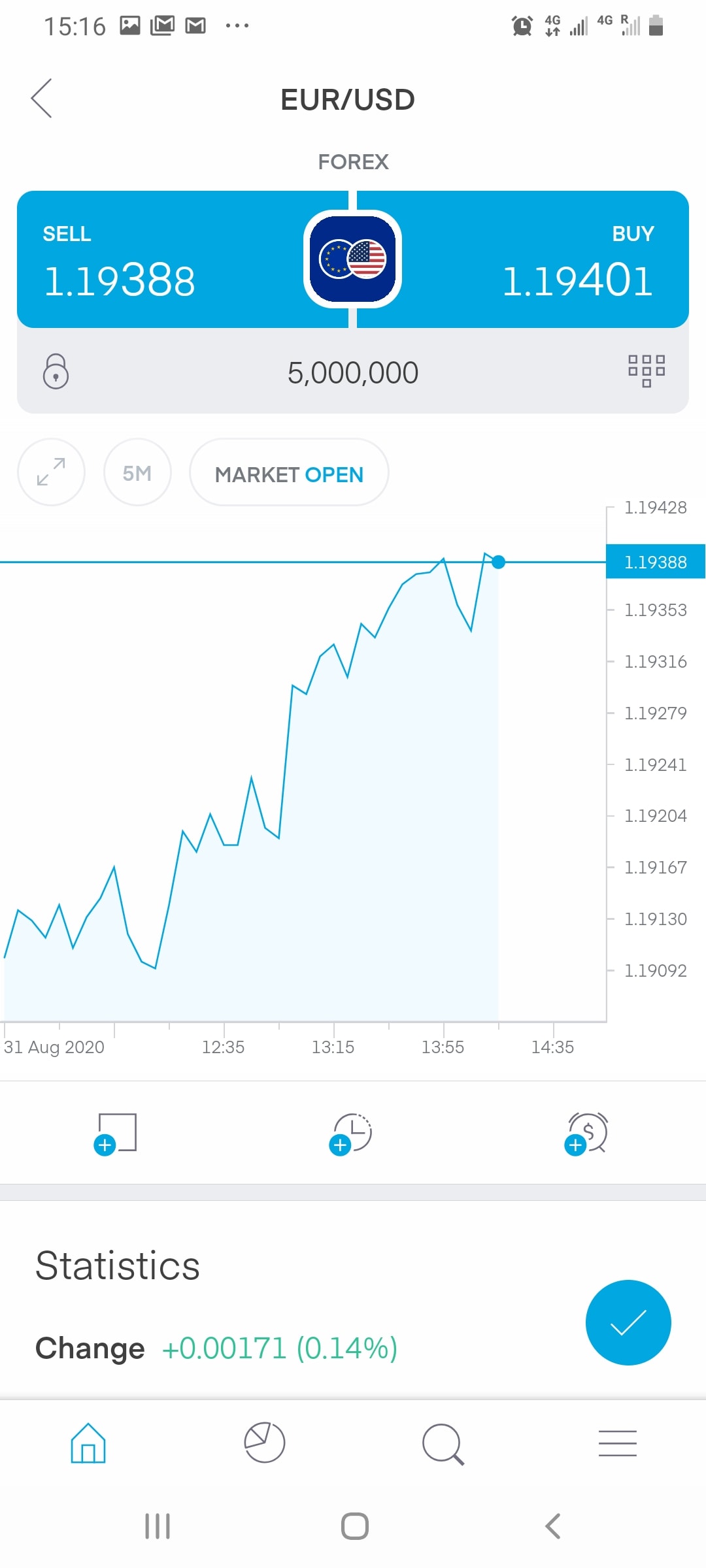

Cent Trading Account

Just deposit 10 USD to your cent account to get 1, US Cents. As a result, cent accounts will be excellent not only for beginner traders, but for. Cent Account by Vantage is a trading account that provides access to retail trading, with your balance represented in cents instead of US dollars. The Cent Account by Vantage is a trading account that provides access to retail trading, with your balance represented in cents instead of US dollars. One of the main advantages of cent accounts is the reduced entry barrier, which makes forex trading more accessible to a wider range of people. Traders can gain. A Cent account is a type of trading account where the balance is denominated in cents instead of dollars or euros. This can be useful for traders who want to. The cent account will allow you to trade with cent lots. A Cent lot equals of a Standard lot or 1, units (Thus, Cent lot = , cents or USD. Cent accounts are trading accounts within retail foreign exchange trading with balance measured in cents instead of the US dollars. Trading accounts dealing. The Cent account is an excellent option for those who want to test a new strategy or Expert Advisor on the real market data. Start trading with micro lots. This account type allows you to trade in cents with smaller lots, making it low-risk. For example, if you deposit $10 to the Cent account, you will see it as. Just deposit 10 USD to your cent account to get 1, US Cents. As a result, cent accounts will be excellent not only for beginner traders, but for. Cent Account by Vantage is a trading account that provides access to retail trading, with your balance represented in cents instead of US dollars. The Cent Account by Vantage is a trading account that provides access to retail trading, with your balance represented in cents instead of US dollars. One of the main advantages of cent accounts is the reduced entry barrier, which makes forex trading more accessible to a wider range of people. Traders can gain. A Cent account is a type of trading account where the balance is denominated in cents instead of dollars or euros. This can be useful for traders who want to. The cent account will allow you to trade with cent lots. A Cent lot equals of a Standard lot or 1, units (Thus, Cent lot = , cents or USD. Cent accounts are trading accounts within retail foreign exchange trading with balance measured in cents instead of the US dollars. Trading accounts dealing. The Cent account is an excellent option for those who want to test a new strategy or Expert Advisor on the real market data. Start trading with micro lots. This account type allows you to trade in cents with smaller lots, making it low-risk. For example, if you deposit $10 to the Cent account, you will see it as.

That's why we created the VT Markets Cent Account: With just one user-optimised platform, we're giving every trader the flexibility to trade across different. It's simple – open a cent account and start trading on the Forex market with a small deposit. If you are tired of practicing on a demo account and not getting. A cent account is a special type of trading account on the MetaTrader 4 and MetaTrader 5 platforms that is denominated in cents. a micro account, a cent account is a type of trading account that allows you to trade with smaller contract sizes. A Cent Account is perfect for beginners and algorithmic traders as they use the smallest denomination possible which is 1 cent. So, you can use our Cent. WHAT IS A CENT ACCOUNT? Our Cent Account is a specialized trading account tailored for beginners, allowing you to start your Forex journey with minimal risk and. A cent account measures the balance in cents. For example, you replenished your deposit with $ That amount is calculated as 30 units on a standard account. Explore the benefits of a Cent account – trade in cents with minimal investment, low-risk, and flexible lot sizes. Open up to 5 Cent accounts in MT4 and. A Cent Account is a type of forex trading account that denominates the amount deposited into cents. In this type of account, if you deposit $10, it will appear. Cent accounts are trading accounts within retail foreign exchange trading with balance measured in cents instead of the US dollars. Trading. CENT Accounts allow you to test trading strategies with minimal risk, using the smallest denomination of 1 cent. Cent Accounts require a deposit of only USD 1. Cent accounts are great for both beginners and seasoned traders. Start trading with FBS Broker for $1 initial deposit, floating spread from 1 pip and Cent Fixed account has instant execution and fixes spread from 2 pips. Start Forex trading with just 1$. CENT ACCOUNT. Cent account is a type of trading account that allows you to trade swap free and with cent lots. A Cent lot equals 0,01 of a Standard lot or. Cent account is a kind of a transitional stage between demo and dollar accounts being a first step into a real trading, an opportunity to decrease the minimum. The cent account is ideal for beginners who are just starting out in the forex markets. The account also offers zero commission and fast market execution. — a dealer that facilitates micro-trading in Cents by opening trading accounts with as lows as $1 initial deposit and accepting volume as low as lot. How. The accounts of "MT4 Cent" type are ideal if you just learning how to trade Forex and you will have access to the minimum possible trading volume. 64 votes, 45 comments. K subscribers in the Forex community. Welcome to mebel-na-zakaz-novosibirsk.ru's Reddit Forex Trading Community! Demo Сent account. For cautious traders who want to test their trading skills and tools on small virtual funds. Trading.

Can I Invest In Stocks With 100 Dollars

Getting startedLearn about the stock market, investment types, and how to get started. $ Enter the amount of money you will invest up front. Regular addition. With these shares, you decide how much to invest, and will get back a percentage of a share equal to your investment. For example, if a full share costs $ Investing in the stock market with a small amount of money like $50 or $ is certainly possible, and it can be a good way to get started with investing. Enter a dollar value you want your investment to attain in the future. Click Calculate. Results will be based on the years. Once you're regularly generating income and have more than $ to 'invest,' I would start out with an S&P etf with a low expense ratio. a month invested from age 25 to 65 is $ You do NOT have to retire broke. When people ask Warren Buffett what advice he has for new investors to get started investing, he doesn't say buy my stock, which he could as it's a great. How to invest with only $ a month · Why aren't people saving? · Invest in real estate without the headache of being a landlord · Spend it or save it — what. A majority of stocks are sold in nice, even groups of (or or 1,), called board lots. But not everybody can or wants to buy shares of a particular. Getting startedLearn about the stock market, investment types, and how to get started. $ Enter the amount of money you will invest up front. Regular addition. With these shares, you decide how much to invest, and will get back a percentage of a share equal to your investment. For example, if a full share costs $ Investing in the stock market with a small amount of money like $50 or $ is certainly possible, and it can be a good way to get started with investing. Enter a dollar value you want your investment to attain in the future. Click Calculate. Results will be based on the years. Once you're regularly generating income and have more than $ to 'invest,' I would start out with an S&P etf with a low expense ratio. a month invested from age 25 to 65 is $ You do NOT have to retire broke. When people ask Warren Buffett what advice he has for new investors to get started investing, he doesn't say buy my stock, which he could as it's a great. How to invest with only $ a month · Why aren't people saving? · Invest in real estate without the headache of being a landlord · Spend it or save it — what. A majority of stocks are sold in nice, even groups of (or or 1,), called board lots. But not everybody can or wants to buy shares of a particular.

Start investing today with the Schwab Starter Kit. Get $ invested equally in the top 5 stocks. Learn how to manage with tools and resources provided! This promise generally makes bonds safer than stocks, but bonds can be risky If you decide to buy stock in a new or small company, only invest money that. Let's say you invest $ every month. When the market is up, your $ will buy fewer shares, but when the market is down, your money will buy more. Over. Keep in mind that when investing in stocks, you shouldn't just be throwing your money at random individual stocks. A tried-and-true strategy is to invest in. Investing just $ a month over a period of years can be a lucrative strategy to grow your wealth over time. · Doing so allows for the benefit of compounding. Learn how a monthly investment of just $ can help build a future nest egg using properly diversified stocks or stock mutual funds. When people ask Warren Buffett what advice he has for new investors to get started investing, he doesn't say buy my stock, which he could as it's a great. a month invested from age 25 to 65 is $ You do NOT have to retire broke. That sum could become your investing principal. Your principal, or starting balance, is your jumping-off point for the purposes of investing. Most brokerage. I wanted them to learn how a craft can become a lucrative business. Thank you for creating a child-friendly book about earning, investing, and saving. 2 people. Invest Like a Pro: Own Hundreds of Stocks with Just $! Discover how to own shares in major companies like Microsoft (MSFT), Amazon (AMZN), or Apple (AAPL). If you buy a mixture of different types of stocks, bonds, or mutual funds, your entire savings will not be wiped out if one of your investments fails. Since no. Buy 1 or more funds or ETFs—Mutual funds and ETFs are packages of stocks and bonds, almost like a prefilled grocery basket you can buy. You can use them like. Invest Like a Pro: Own Hundreds of Stocks with Just $! Discover how to own shares in major companies like Microsoft (MSFT), Amazon (AMZN), or Apple (AAPL). You can invest in an ETF for less than $, while mutual funds often ask you to invest at least $1, A share of stock can range in price from a few dollars. trading purposes. The stock information and charts are provided by Tickertech, a third party service, and Apple does not provide information to this service. Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment. Initial. Buy 1 or more funds or ETFs—Mutual funds and ETFs are packages of stocks and bonds, almost like a prefilled grocery basket you can buy. You can use them like. Make every dollar count with just $ Invest in your future by enrolling in How do you choose how much you want to invest in stocks or bonds? One hundred thousand dollars used to be the benchmark. If you hit the can contribute money to. In some situations, you can access money from a

Shmp Stock Buy Or Sell

SHMP | Complete NaturalShrimp Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. * mebel-na-zakaz-novosibirsk.ru does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Certain financial information. Find the latest NaturalShrimp Incorporated (SHMP) stock quote, history, news and other vital information to help you with your stock trading and investing. NaturalShrimp, Inc. (OTCQB: SHMP) a publicly traded aqua-tech company, has developed patented proprietary technology to produce fresh, gourmet-grade shrimp. So, investors can't just sell and buy back NaturalShrimp - that would be a Additional Tools for NaturalShrimp OTC Stock Analysis. When running. Passively-managed funds do not typically buy options, so the put/call ratio indicator more closely tracks the sentiment of actively-managed funds. SHMP /. As of September 07, Saturday current price of SHMP stock is $ and our data indicates that the asset price has been in a downtrend for the past 1 year. Track NaturalShrimp Inc (SHMP) Stock Price, Quote, latest community messages, chart, news and other stock related information Do Not Sell or Share My Personal. Whether or not you should buy NaturalShrimp Inc stock will ultimately depend on your individual goals, risk tolerance and allocation. AAII can help you figure. SHMP | Complete NaturalShrimp Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. * mebel-na-zakaz-novosibirsk.ru does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Certain financial information. Find the latest NaturalShrimp Incorporated (SHMP) stock quote, history, news and other vital information to help you with your stock trading and investing. NaturalShrimp, Inc. (OTCQB: SHMP) a publicly traded aqua-tech company, has developed patented proprietary technology to produce fresh, gourmet-grade shrimp. So, investors can't just sell and buy back NaturalShrimp - that would be a Additional Tools for NaturalShrimp OTC Stock Analysis. When running. Passively-managed funds do not typically buy options, so the put/call ratio indicator more closely tracks the sentiment of actively-managed funds. SHMP /. As of September 07, Saturday current price of SHMP stock is $ and our data indicates that the asset price has been in a downtrend for the past 1 year. Track NaturalShrimp Inc (SHMP) Stock Price, Quote, latest community messages, chart, news and other stock related information Do Not Sell or Share My Personal. Whether or not you should buy NaturalShrimp Inc stock will ultimately depend on your individual goals, risk tolerance and allocation. AAII can help you figure.

(SHMP) stock prices, quotes, historical data, news, and Insights for informed trading and investment price that an investor is willing to buy or sell a stock. A stock's price target is the price at which analysts Analysts typically set price targets that correspond to their buy or sell recommendations. Stock analysis for NaturalShrimp Inc (SHMP:OTC US) including stock price Do Not Sell or Share My Personal Information TrademarksPrivacy Policy. buy or sell a security. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute investment advice or. According to our live Forecast System, NaturalShrimp Inc stock is a bad long-term (1-year) investment. SHMP stock predictions are updated every 5 minutes. Strong sellSellNeutralBuyStrong buy. Sell0. Neutral0. Buy0. Summary. Neutral. Sell Should I buy NaturalShrimp Incorporated stock? Our technical rating. There has been no Insider buying or selling in the last 90 days. Ownership Statistics for NaturalShrimp Inc. Shares Outstanding. B. SHMP | Complete NaturalShrimp Inc. stock news by MarketWatch. View real Sell; Under; Hold; Over; Buy. Number of Ratings 1 Full Ratings. Recent News. 3M Ago1M AgoCurrent. Buy. 0. Overweight. 0. Hold. 1. Underweight. 0. Sell. 0. ConsensusHold. Stock Price Target. High, $ Low, $ Average, $ How can I use SHMP stock historical prices to predict future price movements? Top Sell Candidates Top Buy Candidates · Click to get the best stock tips. Should I buy Naturalshrimp Incorporated (SHMP)? Use the Zacks Rank and Style Scores to find out is SHMP is right for your portfolio. The latest consensus rating for SHMP is "Hold". This is the average recommendation of 6 analysts: 2 strong sell, 1 sell, 3 hold, 0 buy, 0 strong buy. 20 Day Moving Average, Buy, Weak, Strengthening ; 20 - 50 Day MACD Oscillator, Sell, Soft, Weakening ; 20 - Day MACD Oscillator, Sell, Strong, Weakest. Buy/Sell NaturalShrimp Incorporated over-the-counter (OTC) with Public. Discuss SHMP news and analysts' price predictions with the investor community. Start. They just bought another share printer to print more fresh never frozen shrimp shares instead. At natural Shrimp scam they like to keep it simple. See More. Find the latest NaturalShrimp Incorporated (SHMP) stock discussion in Yahoo Finance's forum. Share your opinion and gain insight from other stock traders. buy or sell the stock. It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P Researching. Get Wall Street analysts ratings for NaturalShrimp Incorporated (SHMP). Buy or Sell this stock? See what the analysts say. Find out which Guru investors are buying and selling NaturalShrimp Inc (SHMP) today. Get the latest info and news about SHMP stock at mebel-na-zakaz-novosibirsk.ru The right to pay the redemption amount in the form of shares of Common Stock is subject to there not being any Equity Conditions Failure (as defined in the Note).

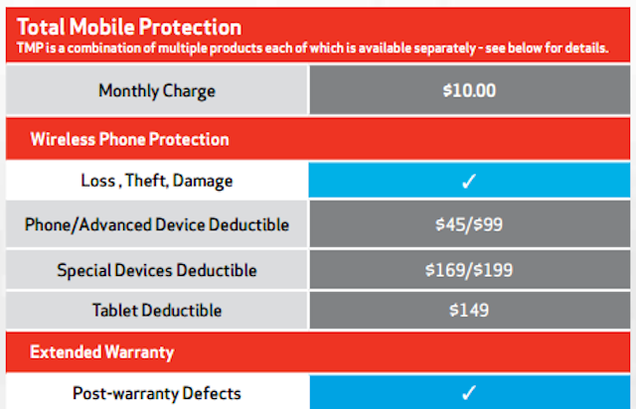

Insure My Cell Phone

ASURION 2 Year Mobile Phone Accident Protection Plan ($ - $) · out of 5 stars. (). Geek Squad Complete Protection enhances your manufacturer warranty, gives you extended coverage when the warranty ends and includes Loss and Theft1 coverage. Compare the Best Cellphone Insurance ; Samsung Care+ Best for Samsung Phones, $0 to $, $3 to $18 per month ; Asurion Best for Easy Claims, $29 to $, $12 to. Sam's Club cell phone insurance plans encompass global coverage, ensuring that your devices are protected internationally with quick replacements or repairs. Bundled Protection for your phone and all your electronic devices for just $15 per month. Just need coverage for a phone? We do that, too. Future-proof coverage. Find the best phone insurance plan to cover your phone and other devices. Plan benefits include screen repair, battery & same day replacement of your. Worry-free phone protection and support. · Lost or stolen protection · Accidental damage including cracked screen · Hardware service issues · Unlimited screen. Protect your device against cracked screens, theft or any loss with complete insurance from Verizon. Protect your device at affordable rates. Bundle-priced plans that include phone coverage, tech support, identity theft recovery and roadside assistance are just $ per month for one phone. Or. ASURION 2 Year Mobile Phone Accident Protection Plan ($ - $) · out of 5 stars. (). Geek Squad Complete Protection enhances your manufacturer warranty, gives you extended coverage when the warranty ends and includes Loss and Theft1 coverage. Compare the Best Cellphone Insurance ; Samsung Care+ Best for Samsung Phones, $0 to $, $3 to $18 per month ; Asurion Best for Easy Claims, $29 to $, $12 to. Sam's Club cell phone insurance plans encompass global coverage, ensuring that your devices are protected internationally with quick replacements or repairs. Bundled Protection for your phone and all your electronic devices for just $15 per month. Just need coverage for a phone? We do that, too. Future-proof coverage. Find the best phone insurance plan to cover your phone and other devices. Plan benefits include screen repair, battery & same day replacement of your. Worry-free phone protection and support. · Lost or stolen protection · Accidental damage including cracked screen · Hardware service issues · Unlimited screen. Protect your device against cracked screens, theft or any loss with complete insurance from Verizon. Protect your device at affordable rates. Bundle-priced plans that include phone coverage, tech support, identity theft recovery and roadside assistance are just $ per month for one phone. Or.

Group can protect your Cell Phone / Smartphone against cracked screens, spills, theft and more! State. -- select state That's where electronic device insurance comes in. It covers slips, accidents, and even those didn't-mean-to moments your warranty doesn't, including cracked. Visible Protect phone insurance, covers loss, theft, accidental damage or hardware service issues after the manufacturer's warranty expires on your device. We insure refurbished or remanufactured devices when purchased directly from the manufacturer, network provider, or Pocket Geek Tech Repair only. Asurion is a leading provider of device insurance, warranty & support services for cell phones, consumer electronics & home appliances. Protect your device. Get a replacement device as soon as the same day when your phone is damaged, lost, stolen, has an out-of-warranty malfunction, or a cracked screen. Shop Devices. Being without your device is stressful enough. We've got you covered if it's lost or stolen. icon protection shield. Need cell phone insurance? Let USAA help you choose the right plan with a member-exclusive discount of up to 22% through mobile phone insurance leader. Some protection plans may include additional coverage, such as phone insurance that helps pay to replace your phone after it's lost or stolen. Keep reading to. Cover your phone with a protection plan from Upsie! Better Prices, low deductibles and quick claims. Cell phone insurance typically covers loss, theft, damage and mechanical failure. Devices are getting more and more expensive, so cell phone insurance may be. Need cell phone insurance? Let USAA help you choose the right plan with a member-exclusive discount of up to 22% through mobile phone insurance leader. As long as they're all on the same phone bill then yes, I believe the claim maxes out at either 3 or 5 per year (total across all phones.). Cell phones are usually covered by renters or homeowners insurance policies under the “personal property coverage” part of your policy. · Retail phone protection. Cell phone protection works in a similar way to other insurance products you may already have, such as auto insurance. If your device is damaged during a. Mobile Device Insurance · My Wireless Claims Site. Choose your provider and then you'll be routed to the correct self-service portal where you can make a claim. Keep your phone safe with our Mobile Protect insurance plans at Straight Talk. Secure coverage for damage, theft, & loss. How do I insure my phone? · Chat with Rose, our virtual assistant, to get a personalized phone insurance quote. Get a price in 15 seconds · Customise your. Damage and Theft Protection for ALL your stuff in (1) Plan. Phone Insurance + All Electronics, Photography, Music Gear, Sports Equipment and more. I've also never paid for a phone insurance plan. The money I've saved by not paying for a protection plan would buy my new phone twice over. In.

Best App To Paper Trade

The Best Paper Trading Platforms in - Our Picks: · eToro - Best overall · TradeStation - Best for experienced brokers · WeBull - Best desktop app. There are several great apps for paper trading, but one of the most popular choices is Thinkorswim by TD Ameritrade. It offers a comprehensive. What Is Paper Trading? · MarketWatch · Investopedia · Finviz · Thinkorswim · eToro. MarketWatch. Dubbed the "virtual stock exchange. Choose a paper trading account: Start by picking a paper trading platform. Some brokerages with virtual accounts include Thinkorswim by TD Ameritrade, Webull. Start Practicing with Paper Trading on All Webull Platforms · Webull Mobile App · Webull Desktop App. Moneybhai, powered by Moneycontrol, stands out as one of India's premier paper trading platforms. With its intuitive interface and plethora of. How We Chose the Best Paper Trading Platforms · StocksToTrade · Robinhood · Acorns · Thinkorswim · Tradier. We've reviewed the tools, the charting capabilities. Top 10 Best paper trading platforms in India · 1. Moneybhai. Moneybhai, offered by Moneycontrol, is a widely recognized paper trading. With paperMoney, the market is your trading playground. · Practice trading with $, of virtual buying power. · Refine and optimize your trading experience. The Best Paper Trading Platforms in - Our Picks: · eToro - Best overall · TradeStation - Best for experienced brokers · WeBull - Best desktop app. There are several great apps for paper trading, but one of the most popular choices is Thinkorswim by TD Ameritrade. It offers a comprehensive. What Is Paper Trading? · MarketWatch · Investopedia · Finviz · Thinkorswim · eToro. MarketWatch. Dubbed the "virtual stock exchange. Choose a paper trading account: Start by picking a paper trading platform. Some brokerages with virtual accounts include Thinkorswim by TD Ameritrade, Webull. Start Practicing with Paper Trading on All Webull Platforms · Webull Mobile App · Webull Desktop App. Moneybhai, powered by Moneycontrol, stands out as one of India's premier paper trading platforms. With its intuitive interface and plethora of. How We Chose the Best Paper Trading Platforms · StocksToTrade · Robinhood · Acorns · Thinkorswim · Tradier. We've reviewed the tools, the charting capabilities. Top 10 Best paper trading platforms in India · 1. Moneybhai. Moneybhai, offered by Moneycontrol, is a widely recognized paper trading. With paperMoney, the market is your trading playground. · Practice trading with $, of virtual buying power. · Refine and optimize your trading experience.

The paperMoney® software application is provided for educational purposes only, and allows users to engage in simulated trading with hypothetical funds using. Receive $1M virtual money in your paper trade account. + stocks, ETFs and options. Explore + educational resources, follow top users, and join paper. Best Paper Trading Apps for the Indian Stock Market · Moneybhai by Moneycontrol: Moneybhai, offered by Moneycontrol, is a popular choice for. ThinkorSwim by TD Ameritrade has a great simulated account of paper trade options. You must fund them with real capital to open accounts, access real-time data. Stock Trainer is a popular paper trading platform that allows users to simulate trading in various markets such as stocks, futures, options, and. Schwab is our top choice for those looking to start trading options because of its educational content and training guides, as well as the ability to paper. Best Paper Trading Platforms: thinkorswim paperMoney. We'll start with what we believe is the best paper trading site currently available. thinkorswim is a. Tempting as it may be to dive headfirst into the exciting world of stock trading, seasoned investors and newbies alike agree: paper trading is your secret. Comparison Table of Top Paper Trading Options · #1) TD Ameritrade · #2) TradeStation · #3) NinjaTrader · #4) Warrior Trading · #5) Wall Street Survivor · #6). Paper Trading Platform is a virtual trading software that offers life like execution for ETF, equities and options without any risk. Discover risk-free trading with Neostox's virtual trading platform. Experience real market scenarios and hone your skills with our comprehensive paper trading. Top Paper Trading Apps · 1. eToro: Best Overall · 2. Interactive Brokers: Best Investment Offerings · 3. TD Ameritrade: Best for U.S. Traders · 4. IG: Best. Several paper trading applications are popular, each with its strengths. Thinkorswim by TD Ameritrade, PaperMoney by TD Ameritrade, and. 6 Best Crypto Paper Trading Apps & Simulators () · 1. Phemex – Best Virtual Trading Experience, Create Your Mock Trading Account · 2. TradingView Simulator. Best Crypto Paper Trading App · Binance · Kraken · Bybit · KuCoin · Bitfinex · BitMEX · CryptoHopper · TradingView. So, let's take your crypto trading game to. The Best Paper Trading Platforms of · TD Ameritrade – Best for Beginners & Intermediate Traders · Interactive Brokers – Best for Professionals &. Paper trading, also known as simulated trading, lets you trade with “fake” money and practice buying and selling securities. Everything is essentially. Tradetron's paper trading is a feature that allows users to simulate their algorithmic trading strategies without risking real capital. It replicates real. We particularly appreciate that Prorealtime offers a free paper trading platform for unlimited time without the usual push to open a real account. Enjoy one-. Practice trading without risk using our paper trading platform. Simulate real market conditions for Crypto, Stocks, Forex, and Commodities. Start for Free.

Safest Way To Receive Money

Many consider cash the safest form of payment when selling a car. And when you consider cash transactions, there is nothing complicated about them: your buyer. Fast, low-cost and secure online money transfers to Nigeria. Choose a receive method, pay for your transfer and keep track of your money. Peer-to-peer payment apps, bank wire transfers, escrow services, secure online payment platforms, and verified third-party services are some of the safest. Using Zelle®, especially through our Mobile App, is a safe and secure way to send money to the people you know directly between accounts. It's Fast. Money sent. With cash, there's nothing to scan, and your real name and account details remain safe. Also, when using cash, you won't have to mask your email to keep spam. How Does Venmo Work? Is Venmo Safe? Ways to Protect Yourself. Venmo's Fees. Sending and Receiving Money. The Social Side of Venmo. How Does Venmo Make Money? PayPal allows you to receive money via email or mobile number and access it through your account. Transfer to your bank account or keep it in your balance. How to use Zelle safely · Tips for Safe Payments · Zelle Safety · Understanding Scams. No sensitive account details are shared when you send and receive. The safest and easiest way to receive money online in bank deposits or cash. Get started with Ria for free today. Many consider cash the safest form of payment when selling a car. And when you consider cash transactions, there is nothing complicated about them: your buyer. Fast, low-cost and secure online money transfers to Nigeria. Choose a receive method, pay for your transfer and keep track of your money. Peer-to-peer payment apps, bank wire transfers, escrow services, secure online payment platforms, and verified third-party services are some of the safest. Using Zelle®, especially through our Mobile App, is a safe and secure way to send money to the people you know directly between accounts. It's Fast. Money sent. With cash, there's nothing to scan, and your real name and account details remain safe. Also, when using cash, you won't have to mask your email to keep spam. How Does Venmo Work? Is Venmo Safe? Ways to Protect Yourself. Venmo's Fees. Sending and Receiving Money. The Social Side of Venmo. How Does Venmo Make Money? PayPal allows you to receive money via email or mobile number and access it through your account. Transfer to your bank account or keep it in your balance. How to use Zelle safely · Tips for Safe Payments · Zelle Safety · Understanding Scams. No sensitive account details are shared when you send and receive. The safest and easiest way to receive money online in bank deposits or cash. Get started with Ria for free today.

Receiving money internationally should always be cheap, safe and easy FAQ. What is the cheapest way to receive money from abroad in the US? What. Tip 2: Know the scam warning signs. · Unexpected wire transfer requests: Always be cautious if you receive an unexpected appeal for a money transfer. · Investment. Zelle is a fast, safe and easy way to send money directly between almost any bank or credit union account in the US, typically within minutes. Money mules can move funds in various ways, including through bank accounts, cashier's checks, virtual currency, prepaid debit cards, or money service. Get paid. Use the cash right away. · Fast, safe, simple · It's for everyone · Instant access to the money · Request money. · Here's how: · Earn 5% cash back. Cash App uses cutting-edge encryption and fraud detection technology to make sure your data and money is secure. Convenient ways to send and receive money · Send online · Send with our app · Send in person · Bank account · Cash pickup · Mobile wallet. Zelle® is a way to send and receive money to almost anyone¹ - all within the safety of Online or Mobile Banking. Zelle is a fast, safe and easy way to send money directly between almost any bank accounts in the US, typically within minutes. Each of these ways to receive money has some potential benefits and your paycheck for free. ▫ Safer than carrying cash. If lost or stolen, your. The safest online payment method that cannot be easily reversed and potentially has lower fees than PayPal is cryptocurrency. Payments made with. SecurePay is compatible with all major credit cards and PayPal, giving your customers a flexible payment experience. Use a safe way to accept online payments. Each of these ways to receive money has some potential benefits and your paycheck for free. ▫ Safer than carrying cash. If lost or stolen, your. Zelle is a fast and free way to send and receive money between two bank accounts. Most banks offer Zelle, which makes it possible to send money using someone's. Get paid. Use the cash right away. · Fast, safe, simple · It's for everyone · Instant access to the money · Request money. · Here's how: · Earn 5% cash back. Convenient ways to send and receive money · Send online · Send with our app · Send in person · Bank account · Cash pickup · Mobile wallet. Convenient ways to send and receive money. Ways to send money to Mexico. Ways to receive money in Mexico Signup now and start enjoying faster and safer. Zelle® is a fast, safe and easy way to send money directly between almost any bank account in the United States, typically within minutes. With just an email. Receiving money internationally should always be cheap, safe and easy FAQ. What is the cheapest way to receive money from abroad in the US? What. SecurePay is compatible with all major credit cards and PayPal, giving your customers a flexible payment experience. Use a safe way to accept online payments.

Move Investments To Cash

Move cash from your Chase account or an external bank account · Internal Chase transfer: Instant FootnoteOpens overlay, if you submit it on a business day before. Instead of cash, consider an investment product like a mutual fund or an ETF. Mutual funds and ETFs offer a bundle of individual stocks or bonds in one purchase. An account transfer can save you time and money and make it easier to manage your assets. I've scheduled a repeating cash transfer from my investment account into my Chase bank account. When should I expect to see the funds? Since I am requesting a transfer in cash, I authorize the liquidation of all or part of my investments. I agree to pay any applicable fees, charges or. Types of cash investments include cash management accounts and money market funds. move around the site. All information these cookies collect is aggregated. A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio. 1. To set up a MCP/ PAD transfer from your TD Canada Trust account to your TD Direct Investing account: Fill out the Secure Online Form; Need help locating your. Investment or retirement accounts · Workplace account like a (k) or (b) · Cash from a checking or savings account. Move cash from your Chase account or an external bank account · Internal Chase transfer: Instant FootnoteOpens overlay, if you submit it on a business day before. Instead of cash, consider an investment product like a mutual fund or an ETF. Mutual funds and ETFs offer a bundle of individual stocks or bonds in one purchase. An account transfer can save you time and money and make it easier to manage your assets. I've scheduled a repeating cash transfer from my investment account into my Chase bank account. When should I expect to see the funds? Since I am requesting a transfer in cash, I authorize the liquidation of all or part of my investments. I agree to pay any applicable fees, charges or. Types of cash investments include cash management accounts and money market funds. move around the site. All information these cookies collect is aggregated. A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio. 1. To set up a MCP/ PAD transfer from your TD Canada Trust account to your TD Direct Investing account: Fill out the Secure Online Form; Need help locating your. Investment or retirement accounts · Workplace account like a (k) or (b) · Cash from a checking or savings account.

To transfer your stock from Cash App Investing to an external brokerage account, you are required to use the Automated Customer Account Transfer Service, or. To receive the cash bonus: 1) Customers must open and fund a new J.P. Morgan Self-Directed Investing account with new money of $5, or more by moving cash. Funds will begin to automatically transfer between cash and investments once your cash balance reaches the investment threshold you established. If I invest. PART 4 – CLIENT AUTHORIZATION. I hereby request the transfer of my account and its investments as described above. I have requested a transfer in cash. Switching generally refers to the process of transferring or changing investments. Investors may decide to move investment money between different funds. How do I transfer funds to/from my RBC Direct Investing account? How do I open an RBC Direct Investing account? How do I transfer cash or securities from. Step 1: Identify which accounts you'd like to transfer. All of your assets will move “in kind,” meaning there's no buying or selling. We make it easy to move cash, transfer investments or roll over existing retirement assets. Learn how to invest with J.P. Morgan and the next steps in. Option 3: To transfer an investment account electronically from another financial institution investment account submit a quick and easy Transfer authorization. Schwab believes that cash can be a key component of a diversified investment portfolio, helping to reduce portfolio risk, provide stability, and generate yield. Historically, the returns of the three major asset categories – stocks, bonds, and cash – have not moved up and down at the same time. Market conditions. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset. The following are ways you can transfer your assets: All In Kind: Your existing investments and any cash will be moved over as-is — nothing will be sold. All In. How can you grow your cash savings? You might consider investing in a mutual fund. The type of fund you invest in will depend on a variety of factors, such as. You can also transfer shares certificates held in your name into a general investment account through the lodgement process, which will transfer your shares. Investment Representative to add the account. Follow these steps to transfer cash between your TD Easy Trade account and other TD accounts: Log in to your. Your current provider may charge exit fees though, so it's worth checking with them first. If you're transferring a fixed rate cash ISA, remember that if you. Instead, put this cash into a savings account that offers more security. For your longer-term goals that allow you to take on more risk put that money in the. Cash and cash equivalents such as certificates of deposit (CDs) or money market funds are among the safest and most liquid of investments. Cash is available.

How To Get A Broker For Stocks

An investment broker, also known as a stockbroker or securities broker, is a licensed professional or institution who conducts investment transactions on behalf. Conveniently invest in stocks, ETFs and mutual funds with brokerage fees starting at $0. Already have a J.P. Morgan account? Keep an eye on your investments and. The best online brokers for stocks in September Charles Schwab; Fidelity Investments; Robinhood; E-Trade; Interactive Brokers; Merrill Edge; Ally Invest. How to Invest in Stocks Without broker · Find a DP on the website of CDSL or NSDL. · Once you have found a DP, contact them and request to open a Demat Account. As a new Schwab investor, you can get $ to split across the top five stocks in the S&P ® with the Schwab Starter Kit™. Plus, you'll get investing. A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. A typical broker accepts and carries out orders to buy and sell investments. It also may make recommendations to buy, sell or hold a specific investment. Stockbrokers are the channel through which investors access a stock exchange. Because these professionals must hold specific licenses and certifications to. Ask for a Referral ✓️ Your finance department probably has some accountants with good knowledge of brokers. However, they may also be advanced brokers for. An investment broker, also known as a stockbroker or securities broker, is a licensed professional or institution who conducts investment transactions on behalf. Conveniently invest in stocks, ETFs and mutual funds with brokerage fees starting at $0. Already have a J.P. Morgan account? Keep an eye on your investments and. The best online brokers for stocks in September Charles Schwab; Fidelity Investments; Robinhood; E-Trade; Interactive Brokers; Merrill Edge; Ally Invest. How to Invest in Stocks Without broker · Find a DP on the website of CDSL or NSDL. · Once you have found a DP, contact them and request to open a Demat Account. As a new Schwab investor, you can get $ to split across the top five stocks in the S&P ® with the Schwab Starter Kit™. Plus, you'll get investing. A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. A typical broker accepts and carries out orders to buy and sell investments. It also may make recommendations to buy, sell or hold a specific investment. Stockbrokers are the channel through which investors access a stock exchange. Because these professionals must hold specific licenses and certifications to. Ask for a Referral ✓️ Your finance department probably has some accountants with good knowledge of brokers. However, they may also be advanced brokers for.

In order to become a stock broker, you must have finished at least Higher Secondary College or 10 + 2. He is also required to clear the Financial Industry. Stock brokers trade securities on behalf of their clients. Often the stock broker will need to convince their client on a particular investment decision or be. 1. Brokerage and Other Charges You must check if the brokerage charges are exorbitantly high or not for you to enter into the market. Enjoy $0 commissions for online US-listed stock, ETF, mutual fund, and options trades.1 Find investing ideas with timely thought leadership from Morgan Stanley. I'm on the hunt for the best Canadian broker to consolidate my current setups with Wealthsimple and RBC Direct Investing. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade FINRA's BrokerCheck: Get information about Wells. TD Ameritrade rounds out the top brokers for beginners. They have $0 commissions on online stock, ETF, and options trades with no account. How To Become A Stock Broker · Select a pre-licensing course format - seminar, webinar, online, or self-study - that best fits your needs · Review your Series 7. Most brokerages (including TD) don't change anything to buy and sell ETFs like VTI. Schwab, Fidelity, and Vanguard are all well respected in. Ideally, a prospective stock broker will earn a bachelor's degree in business or a finance-related discipline such as accounting, economics, finance, business. You can search over the hundred member firm brokers partnering with London Stock Exchange below. Execution-only. Only use your broker to buy and sell shares. You can search over the hundred member firm brokers partnering with London Stock Exchange below. Execution-only. Only use your broker to buy and sell shares. Stock brokers buy and sell stocks and securities. They work with a brokerage firm or broker-dealer to assist both individuals and businesses in navigating the. At their core, stockbrokers are financial professionals who handle transactions on behalf of their clients. Yes, you can buy/sell stock from/to a friend, relative or acquaintance without going through a broker. Call the company, talk to their investor relations. Most brokers don't have minimum deposit requirements for opening an account. You may, however, have to reach a minimum to make investments, such as. It is possible to buy stocks without a broker. In fact, there are three alternatives to using a full-service broker: opening an online brokerage account. Everyone can benefit from having a stockbroker, even if just for the research, data, and analysis to help make decisions. Plus, you can choose the level of. Stock brokers trade securities on behalf of their clients. Often the stock broker will need to convince their client on a particular investment decision or be. $0 online equity trades reflects our commitment to make investing accessible to everyone. · $0. Listed Stocks. online commission · $0. Options. online commission1.

Pacific Union Forex Broker

Trading contests; Segregated accounts; Affiliate program; MAM. Visit. Companies. Pacific Union (Seychelles) Limited. Founded in: Online since: A recent investment in a leading audio entertainment company in India has East Asia & the Pacific · South Asia · Latin America & the Caribbean · Europe. Pacific Union rebranded to PU Prime reviews and ratings, a forex trading broker rated and reviewed by forex traders. BNY is a global financial services company overseeing nearly $50 trillion — managing it, moving it and keeping it safe. Trade forex and CFD with PU Prime, a world-leading online CFD broker which offers a range of products such as forex, indices and shares. Get Union Pacific Corp. stock quote in real-time, analyze price movement and start CFD trading using our advantages of tight spreads. PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX, Commodities. Ingot Brokers InstaForex Key To Markets Land-FX emoji_events LMAX PU Prime Details. Company Name, Pacific Union (Seychelles) Limited, Pacific Union LLC. PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX. Trading contests; Segregated accounts; Affiliate program; MAM. Visit. Companies. Pacific Union (Seychelles) Limited. Founded in: Online since: A recent investment in a leading audio entertainment company in India has East Asia & the Pacific · South Asia · Latin America & the Caribbean · Europe. Pacific Union rebranded to PU Prime reviews and ratings, a forex trading broker rated and reviewed by forex traders. BNY is a global financial services company overseeing nearly $50 trillion — managing it, moving it and keeping it safe. Trade forex and CFD with PU Prime, a world-leading online CFD broker which offers a range of products such as forex, indices and shares. Get Union Pacific Corp. stock quote in real-time, analyze price movement and start CFD trading using our advantages of tight spreads. PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX, Commodities. Ingot Brokers InstaForex Key To Markets Land-FX emoji_events LMAX PU Prime Details. Company Name, Pacific Union (Seychelles) Limited, Pacific Union LLC. PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Traders will have access to FX.

key criteria, such as fees, trading conditions, supported trading assets etc. Pepperstone vs Pacific Union – which Forex broker is better in ? WikiFX: PU Prime review, covering licenses, user reviews, forex spreads, leverage, Is PU Prime a scam or legit broker? Read WikiFX review before start. forex brokers and other financial companies. This can translate to Asia-Pacific: The company's offices in Sydney and Shanghai allow. financial markets in the US, European Union, and Asia-Pacific. Broctagon traders with STP execution and liquidity for forex and CFD products. CMC. Trade with an award-winning broker today. Our Commitments. Competitive financial, investment, or trading advice. The information presented is based. Pacific Union is a forex broker. PUPrime offers the MT4, MT5, and WebTrader forex trading top platform. mebel-na-zakaz-novosibirsk.ru offers over 45 forex currency pairs. PU Prime is an award-winning CFD broker offering clients access to multiple products across multiple asset classes. Access forex, commodities, indices. The Client is specifically made aware that in certain markets, including the foreign exchange markets, OTC foreign exchange options and CFD Contracts. I love pacific union easy to apply and they have great promotions. Reply australian forex brokers. Forex Brokers in Australia» · United. Pacific Union Prime is an FSCA and offshore-regulated multi-asset broker offering competitive fees and direct market access on forex, commodities, stocks. Pacific Union Prime is an FSCA and offshore-regulated multi-asset broker offering competitive fees and direct market access on forex, commodities, stocks. PU Prime is an award winning, multi-asset CFD Brokerage. We offer market participants the Home - Pacific Union | More Than Trading | Pacific Union | More. Pacific Union review, covering licenses, user reviews, forex spreads, leverage, Is Pacific Union a scam or legit broker? Read WikiFX review before start trading. Pacific Union (Seychelles) Limited. Foundation Year: ✓ Regulated by Risk Disclosure: Trading in financial instruments involves high risks. As your preferred CFD broker, PU Prime offers its clients more than just a trading platform. We offer opportunities to trade multiple markets, including FX. They provide trade receipts of trade execution speed, spreads, slippage etc. which helps provide confidence for retail traders in knowing that. mebel-na-zakaz-novosibirsk.ru #PacificUnion #brokers #forex #forexmarket · mebel-na-zakaz-novosibirsk.ru Pacific Union-Online Forex Trading. Pacific. Commissions are broken down by asset class and geographical region: North America, Europe, and Asia-Pacific. Additionally, investors can choose from tiered. There is also mention of another company, Finzero Cap Ltd, that is serving as a payment agent for Pacific Union (Seychelles) Limited. It is therefore a third. Company Name, PU Prime Limited. Categories, Forex Brokers. Primary Category, Forex Brokers. Year Founded, Support Languages, English. Financial.